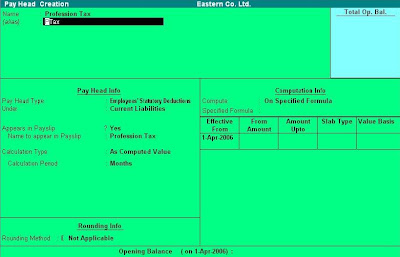

- Pay Head Type : Here select the option Employees Statutory Deductions as the amount will be deducted from the Gross pay of the employee as per statutory regulations.

- Under : Here in this field select Current Liability as the organisation is liable to pay the amount so deducted to the concerned government authorities.

- Calculation Type : Here select 'As Computed Value' from the options as the amount of this Pay Head is dependent on the value of other Pay heads like Basic, HRA, Conveyance, etc.

Computation Info : Here in this Part you have to give the necessary details for computation of Professional Tax. It is described below :

Compute : As the amount of profession tax is based on selected earning pay heads, select 'On Specified Formula'. After selection of the option select the Pay Heads involved and specify the formula and then specify the slab. Select 'Percentage' in slab type column if the amount is calculated on percentage basis. If the amount is a fixed value specify 'Value Basis' in the Slab Type Column.

After you are done with the selection Accept to save the Pay Head.

Other Pay Heads can also be Created in a similar way.

0 comments:

Post a Comment