Latest Entries »

Nov 18, 2009

ST-3 Report

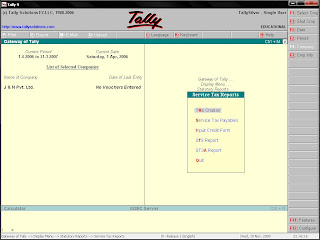

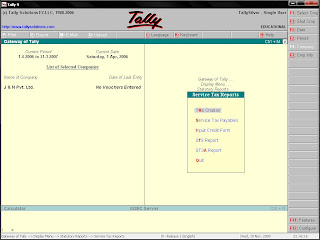

Return for Service Tax is supposed to be filed in Form ST-3 with the Service Tax Department . To print the return in Form ST3, select the option under Service Tax Reports menu. There you will get the Service Tax Return containing details with regard to the value of taxable service charged, value of taxable service realized, Service Tax paid and due. To get a print of this form, from Gateway of Tally, select Display then Statutory Report, select Service Tax Reports then ST3 Report.

Labels:

Service Tax,

ST-3 Report

Input Credit Form

If an organisation has the opportunity to adjust input credit of service tax paid on purchase of service, Tally will automatically generate input credit of service tax based on the transaction recorded by the user, a report called Input Credit Form. The report will display detailed information regarding the amount of input credit, that may be availed against payment of Service tax. The Input Credit Form should be printed after payment of the purcahse service bill. To get this report go to Display from Gateway of Tally, then select Statutory reports, from there select Service Tax Reports, there you can find the Input Credit Form.

Labels:

Service Tax

TR-6 Challan for Submitting Service Tax

In order to submit Service Tax to the Government, TR-6 challan is required.To get this challan you have to go to Display menu from Gateway of Tally then go to statutory reports and then select Service Tax Reports, there you will get Tr-6 challan. You can get the print configuration screen of TR-6 challan. To print TR-6 challan set the options there as per your requirement and Press 'y' at the "Print?" screen.

Subscribe to:

Comments (Atom)

Basics about Tally

Copying masters from one company to another

Cost Category and Cost Centre

Download ODBC software

Download PayCheck 2.0 software

Download Tally 7.2

Download Tally 7.2 to Tally 9 Migration Utility

Download Tally 9

Excise Duty

Export and import data from one company to another

Exporting of Data from Tally

Fringe Benefit Tax(FBT)

Group Company

Importing Data to Tally

Interest Calculation

Multi Columnar Reports

Multiple comapny activation

Scenario

Security Levels

Security of data

Service Tax

Split Financial Year

Tax Collected at Source(TCS)

Tax Deducted at Source(TDS)

Value Added Tax(VAT)

Voucher Entries

Web enabled features of Tally